Election Day is November 8, 2022

Every four years citizens have the opportunity to vote on Sheridan County’s General Purpose Excise Tax known as the One-Cent Optional Tax. This One-Cent Optional Sales Tax has been in continuous effect since 1989 and funds various projects of public benefit in Clearmont, Dayton, Ranchester, Sheridan, and throughout Sheridan County.

The One-Cent Tax has been continuously renewed by Sheridan County voters since 1988.

$157M

generated for community infastructure and services since first passage in 1979.

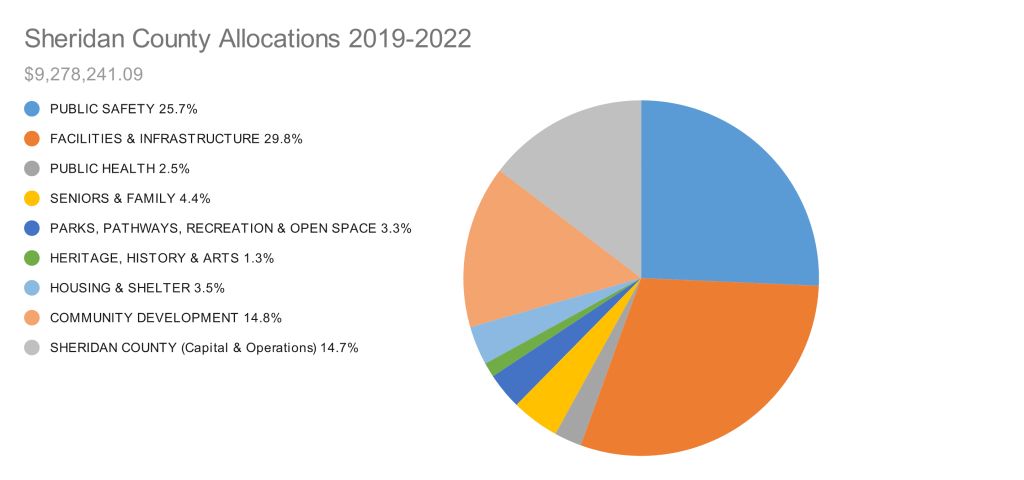

County-Wide One-Cent Allocations 2019-2022

$9.27M

SHERIDAN COUNTY

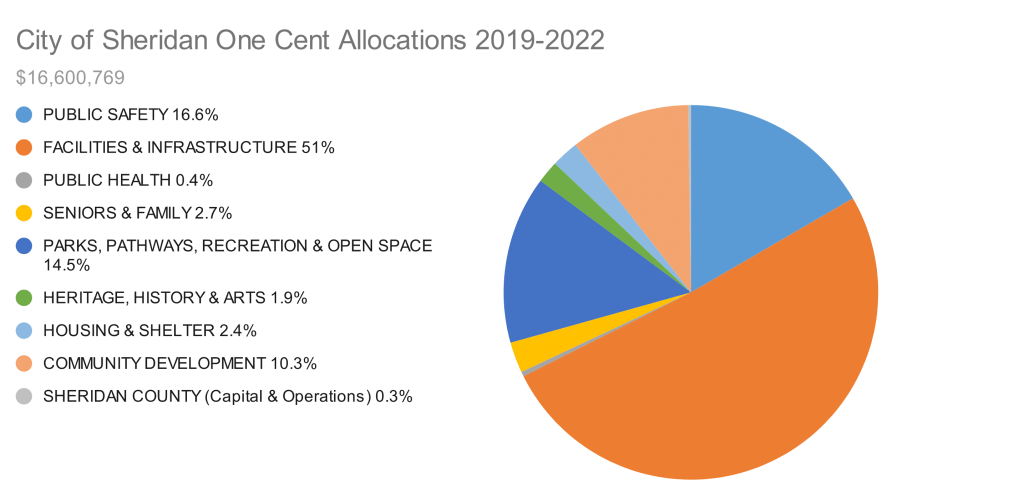

$16M

CITY OF SHERIDAN

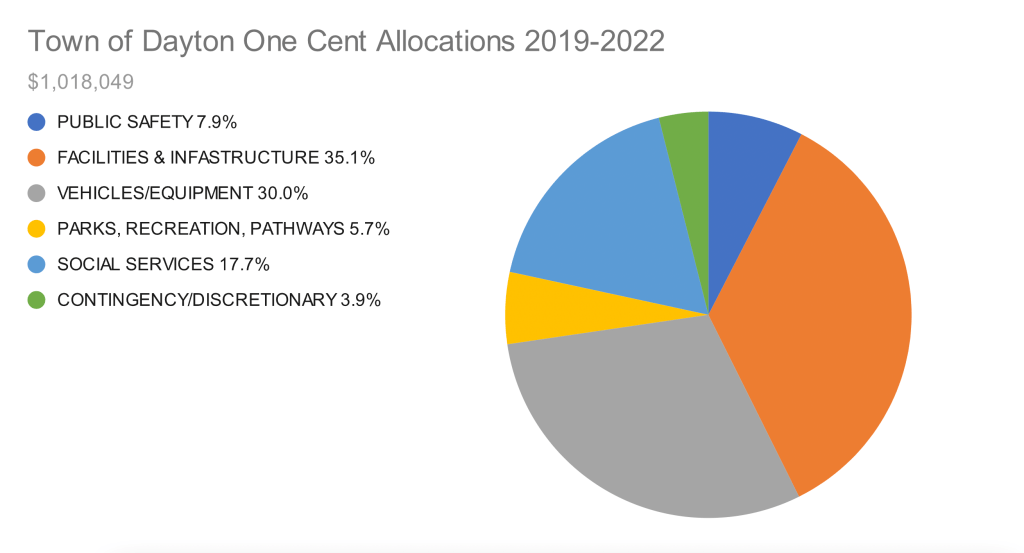

$1M

DAYTON

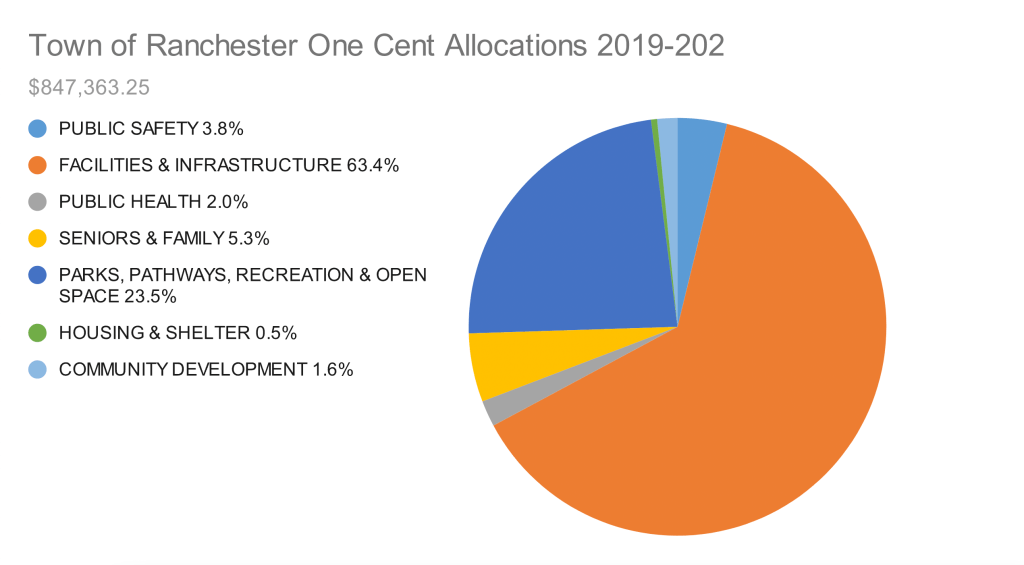

$847K

RANCHESTER

$144K

CLEARMONT

Many public projects across Sheridan County are paid for in part by One-Cent Funds. From Public Safety to Community Development and Facilities and Infrastructure projects to Seniors & Family and Public Health funding, the Arts and Outdoor Spaces to our beautiful Parks and Pathways. All communities in Sheridan County participate in the Optional One-Cent Sales Tax, including Acme, Arvada, Big Horn, Sheridan, Clearmont, Dayton, Leiter, Parkman, Ranchester, Story, Ucross, Wolf and Wyarno.

ONE CENT QUICK FACTS

- The Sheridan County Optional One-Cent Sales Tax was last renewed on Nov 6, 2018.

- Sheridan County citizens have voted in favor of the One-Cent Optional Sales Tax continuously since 1988.

- Roads, Infrastructure, Public Safety, Parks and Pathways, Senior Services, Community Development, and many other projects and services are funded in part by the Optional One-Cent.

- Optional One-Cent Sales Tax is collected only on items subject to sales and use tax. It does not apply to most food purchases, rent, real estate purchases or gasoline.

- According to the Wyoming Office of Tourism, more than 12 percent of the Optional One-Cent Sales Tax is paid by out-of-county visitors and tourists.

- Sheridan County sales tax is currently 6 percent. If the One-Cent Optional Sales Tax is renewed, sales tax will not increase.

- Optional One-Cent revenues are used as matching funds to obtain grants, allowing Sheridan County and surrounding municipalities the opportunity to complete infrastructure projects and community improvements.

FAQ

The Sheridan County Optional One-Cent Sales Tax was last renewed on Nov 6, 2018. Sheridan County citizens have voted in favor of the One-Cent Optional Sales Tax continuously since 1988. Roads, Infrastructure, Public Safety, Parks and Pathways, Senior Services, Community Development, and many other projects and services are funded in part by the Optional One-Cent. Optional One-Cent Sales Tax is collected only on items subject to sales and use tax. It does not apply to most food purchases, rent, real estate purchases or gasoline. According to the Wyoming Office of Tourism, more than 12 percent of the Optional One-Cent Sales Tax is paid by out-of-county visitors and tourists. Sheridan County sales tax is currently 6 percent. If the One-Cent Optional Sales Tax is renewed, sales tax will not increase. Optional One-Cent revenues are used as matching funds to obtain grants, allowing Sheridan County and surrounding municipalities the opportunity to complete infrastructure projects and community improvements.

ONE CENT PAST PROJECTS MAP

Use the map below to explore projects in your community that have been funded through the One Cent Optional Tax. Zoom into the area you wish to explore in order to view all projects in that area. For more information about each project, click on the highlighted point, street, or road section on the map. A legend about the project information is included below the map.

Please note: This map is intended solely as an informational resource to give viewers a general sense of how the One Cent Optional Tax has been used throughout Sheridan County. The locations of such projects or related information (road lengths, etc.) should not be construed as the exact measurements of the project.

If you have any difficulty viewing the embedded map, try a different browser or please click through to the full map.

The interactive map below features past One-Cent projects in the following categories:

- Community Development

- Facilities & Infrastructure

- Heritage, History & Arts

Housing & Shelter - Parks, Pathways, Recreation and Open Space

- Public Health

- Public Safety

- Seniors & Family

Legend

Color: Projects are color-coded according to the category in which they are placed. Pink indicates streets/roads/bridges; blue indicates utilities; and green indicates facilities. Projects that may include more than one category are typically listed as utilities.

Tax Cycle: Project timeline/years.

Total Project Cost: Total cost of the project.

Entity: The Sheridan County entity that completed the project (e.g. Town of Ranchester, Sheridan County, etc.)

Description: Description of the project components and need.

ONE CENT PAST PROJECTS PHOTO GALLERY

Photos of various projects funded in part by the One Cent Optional Tax since 2012.

- City of Sheridan

- Sheridan County

- Ranchester

- Dayton

- Clearmont

*The documents listed here show allocations from each entity in 2018 and 2014 as *projected numbers prior to each election year, as compared to 2019-22 numbers above that are reported past allocations.

PAST ALLOCATIONS:

CONTACT

For more information on past & proposed One Cent Optional Sales Tax projects, please contact your elected officials

SHERIDAN CITY COUNCIL

675-4202

SHERIDAN COUNTY COMMISSION

674-2900

CLEARMONT TOWN COUNCIL

758-4465

DAYTON TOWN COUNCIL

655-2217

RANCHESTER TOWN COUNCIL

655-2283

The Optional One Cent Tax (General Purpose Excise Tax) is on the ballot every four years.

Election Day IS November 8, 2022

Copyright 2023 – Sheridan County Wyoming.